Cheap crypto miners for sale

Sizing Up 17 Bitcoin Miners For 2022

Cheap crypto miners for sale

Jan. 27, 2022 12:02 PM ETANY, ARBK, ARBKF, BITF, BITQ, BKCH, BTC-USD, BTCM, CIFR, CORZ, DAPP, DGHI, ETH-USD, GREE, GREEL, HIVE, HUT, MARA, RIOT, SDIG29 Comments16 Likes

Summary

Cheap crypto miners for sale

- Bitcoin mining stocks have been caught up in the extreme market volatility and pressured by the crypto selloff to start 2022.

- The segment remains in a high-growth phase with companies ramping up mining production, generating real cash flows supporting a positive long-term outlook.

- We highlight 17 bitcoin and crypto mining stocks along with the industry themes to watch in 2022.

- Looking for more investing ideas like this one? Get them exclusively at Conviction Dossier. Learn More »

- Cheap crypto miners for sale

Cheap crypto miners for sale

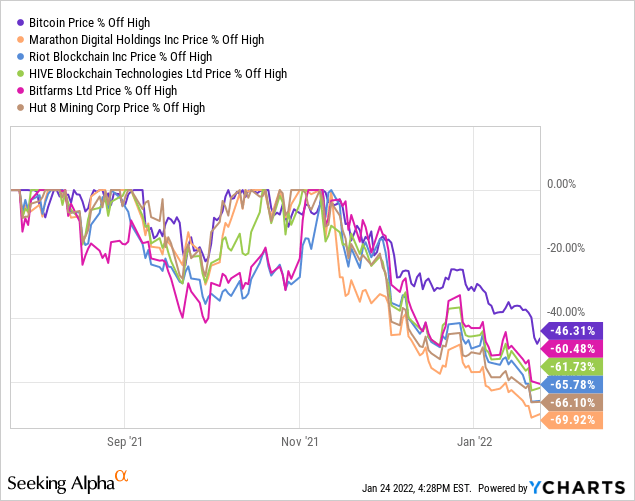

It’s been a wild ride for Bitcoin (BTC-USD) and the entire crypto sector facing extreme volatility to start the year. BTC currently trading around $36,500 is down nearly 45% from its all-time high in the context of the broader stock market selloff with technology and high-growth names leading lower. In this regard, the action has been worse for crypto stocks and bitcoin mining companies earning their reputation as one of the more speculative and high-risk corners of the market.

Cheap crypto miners for sale

Still, we highlight Bitcoin miners as a high-growth group with significant long-term opportunities and a sense that the recent selloff has already gone beyond the underlying fundamentals. Recognizing any bullish thesis for crypto stocks is going to need the price of Bitcoin to stabilize and ultimately rebound higher, we are encouraged on what appears to be some relative value among several beaten-down leaders. Today we are looking at themes in Bitcoin at the start of 2022 and how bitcoin mining stocks stack up.

What is Bitcoin Mining?

Cheap crypto miners for sale

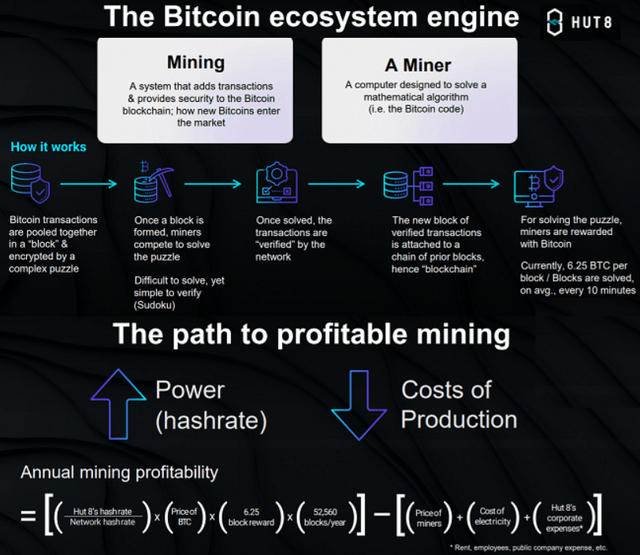

Bitcoin mining as a business model is relatively simple. The companies acquire and operate the specialized computer hardware equipment with application-specific integrated circuits “ASIC”. The setup is typically installed in a data center integrated into a system that continuously works to solve the Bitcoin code to earn the network reward for the verified blockchain transactions.

Cheap crypto miners for sale

Currently, the global bitcoin network awards 6.25 BTC per block, and each block is solved on average every 10 minutes as a protocol to the decentralized system. Over a year, approximately 52,560 blocks are awarded on the network meaning 328,500 BTC are newly minted. At the current market price of BTC, $12.0 billion are up for grabs as an annual “addressable market” value.

The other side of the equation is the production costs. The mining infrastructure requires significant power consumption at scale which drew a lot of attention in 2021. China went so far as to a complete ban on bitcoin mining citing the strains on the electricity grid while other countries like Russia and Sweden continue to discuss regulations. The result has made the United States something of a haven for the industry with the bitcoin miners making an effort to “turn green” including the use of more renewable energy or building out their own low-cost power sources.

Bitcoin Mining Remains Profitable

Cheap crypto miners for sale

The main point here is that bitcoin mining remains profitable even in the current volatile pricing environment with most companies reporting a breakeven cost under $10,000 per BTC. Consider a top-of-the-line “Bitmain Technologies” ANTMINER S19j Pro released in July of 2021. The unit has a hash rate capacity of 104TH/s with a specified 3,068 watts on-the-wall power consumption. Assuming a cost per KW/h of electricity at $0.05, which is reasonable for industrial users in several U.S. states, widely available bitcoin mining profit calculators online show that this single piece of hardware can generate a profit of approximately $15 per day at a bitcoin price of $36.5k taking into account average electricity costs and current network hash rate.

Cheap crypto miners for sale

Over a year, that $15 per day translates to an estimated gross profit of $5,475 representing a payback period of under 2-years on the unit cost. Note that the miners are typically receiving bulk discounts compared to the retail list price including through preferential supply contracts meaning even more favorable unit economics.

The kicker here really comes down to scale, as mining companies are deploying thousands of these machines and focusing on low-cost electricity to improve margins. Marathon Digital Holdings Inc (MARA), for example, expects to operate a fleet of 199,000 miners by early 2023 including even more powerful newer models.

Cheap crypto miners for sale

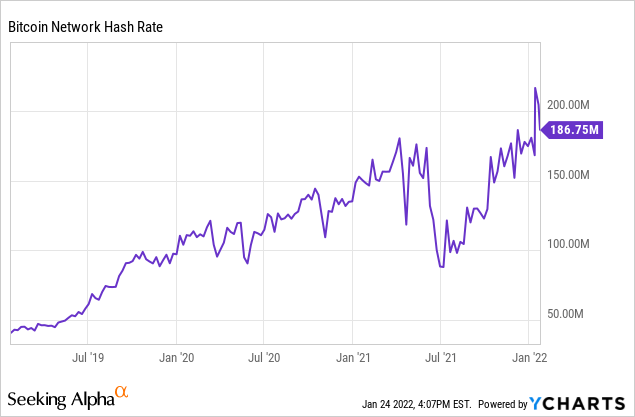

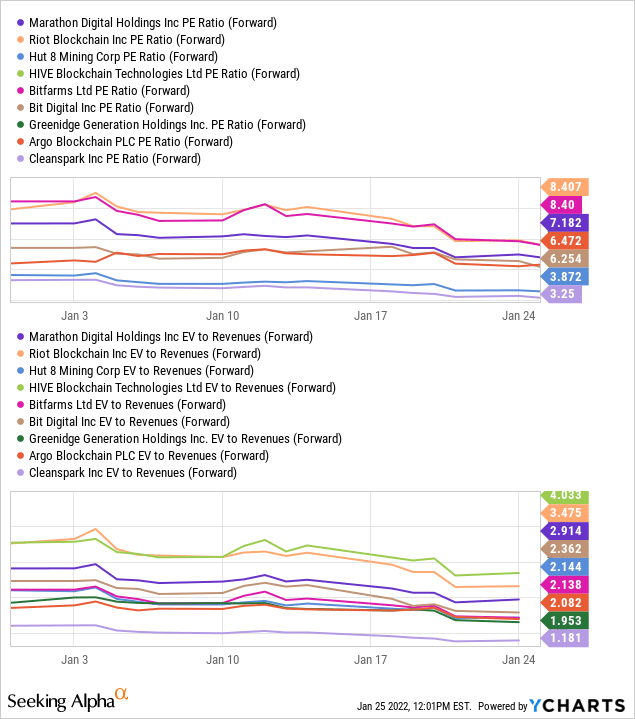

The larger the proportion of each miner’s network share, the larger share of newly minted bitcoins they can receive. On the other hand, all that new mining capacity coming online ends up adding to the Bitcoin network hash rate thereby diluting each company’s share. From the chart below, we can see that the network “difficulty” currently approaching 186.75 EH/s has climbed about 25% over the past year. The expectation is that this figure climbs further as mining companies add machines to the network diluting each company share.

Cheap crypto miners for sale

The understanding is that as long as a mining company can expand capacity above the network difficulty growth rate, or the market price of Bitcoin climbs higher, the business remains viable long term. There is also a dynamic where older, less efficient mining machines lose profitability past their useful life cycle and are taken offline balancing some of the additions to the network. Overall, it’s clear the network difficulty will climb over time, but likely at a decelerating pace in percentage terms going forward.

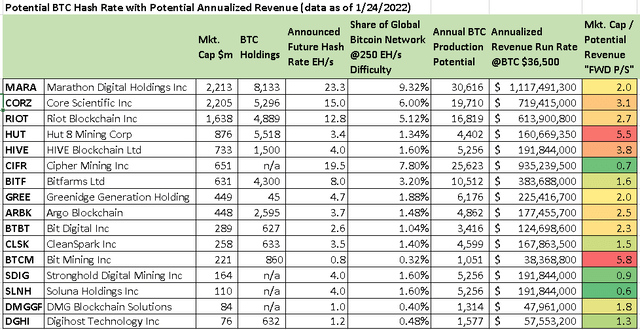

How to Analyze Bitcoin Mining Stocks

The key metric for the industry is each company’s hash rate as the processing power of each company’s fleet of miners across different models. The publicly traded mining company with the current largest hash rate is Core Scientific Inc (CORZ) with a current hash rate capacity of 6.6 EH/s implying the company controls 3.5% of the global bitcoin network. We mentioned Marathon Digital which last reported a hash rate of 3.5 EH/s while there is also Riot Blockchain Inc (RIOT) with 4.1 EH/s as the three largest Bitcoin mining stocks.

From this number, we can imply a current level of daily and annualized Bitcoin production with a corresponding revenue value in Dollar terms against current market pricing and the network hash rate. The more important point is the forward outlook for production growth considering each company’s announced plans for expansion and future hash rate potential. From there, the market is largely valuing these companies across several factors.

- Existing hash rate

- Announced purchases for mining machine deliveries (future hash rate).

- Bitcoins/ digital currencies on their balance sheet (treasury positions).

- Power infrastructure source (Electricity generation partnerships/ power purchase agreements/ company-owned facilities).

- Datacenter and hosting arrangements

- Operating jurisdiction (Asia/Canada/US/Europe).

- ESG credibility (premium for “green mining”).

- Expansion strategy.

- Ancillary businesses (other related blockchain tech businesses).

- Corporate governance visibility.

- Current financial position (early stages of profitability/ cash flow trends).

17 of the Biggest Crypto Mining Stocks

Since 2020, the industry has evolved making apples-to-apples comparisons more difficult. There are a select few groups of pure-play Bitcoin miners while other companies also mine other cryptocurrencies like Ethereum (ETH-USD) or have diversified operations into other related blockchain technologies and services. Companies like HIVE Blockchain (HIVE) and Hut 8 Mining (HUT) have historically focused on ETH but are expanding with BTC. In these cases, the companies are breaking out their smaller BTC capacity while reporting an “effective” blended hash rate for all digital asset mining.

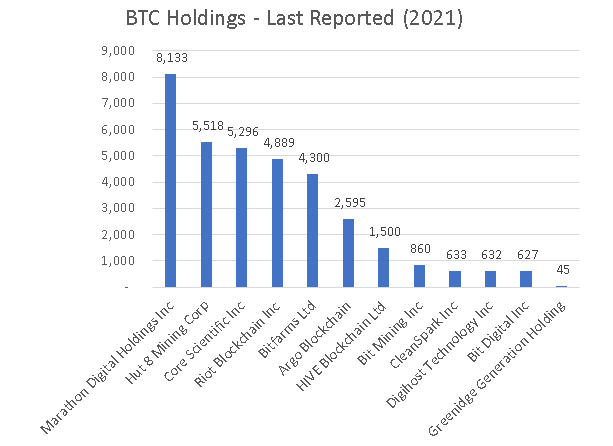

Furthermore, even at the operating level, some companies own their own data centers and power generation facilities while other companies have gone in the direction of partnerships or supply agreements. The result is that it’s more complicated than simply, the miner with the largest hash rate capacity is more valuable. There is also a wide degree of differences between each miners balance sheet digital assets holdings. Some companies have made an effort to hold onto every mined Bitcoin through a “HODL” strategy while others are using the production to generate cash flows. Marathon Digital even took the step of investing $150 million in BTC on the open market last year.

Over the past year, several new companies have become publicly traded like CORZ along with Cipher Mining Inc (CIFR), Stronghold Digital Mining Inc (SDIG), and Greenidge Generation Holdings (GREE). “Gryphon Mining” is still in the process of completing a merger with Sphere 3D (ANY) in a transaction expected to close this quarter. Another theme in 2021 was several companies up-listing from the over-the-counter market into NASDAQ which was the case for HUT, HIVE, Argo Blockchain plc (ARBK), Bitfarms Ltd. (BITF), as well as Digihost Technology Inc (DGHI).

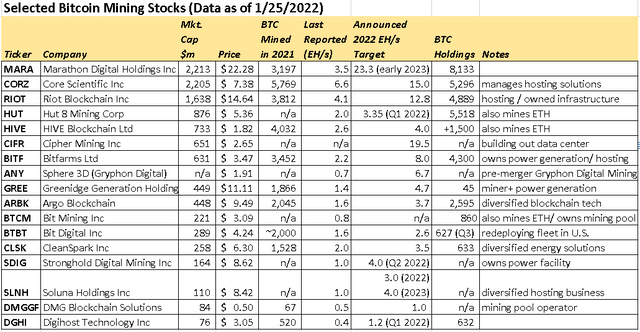

We’ve assembled a list of the 17 largest mining stocks with some of the relevant metrics. To be clear, this list is not intended to be all-inclusive but provides a good starting point for further research and our discussion.

Bitcoin Miners Ramping Up Production in 2022

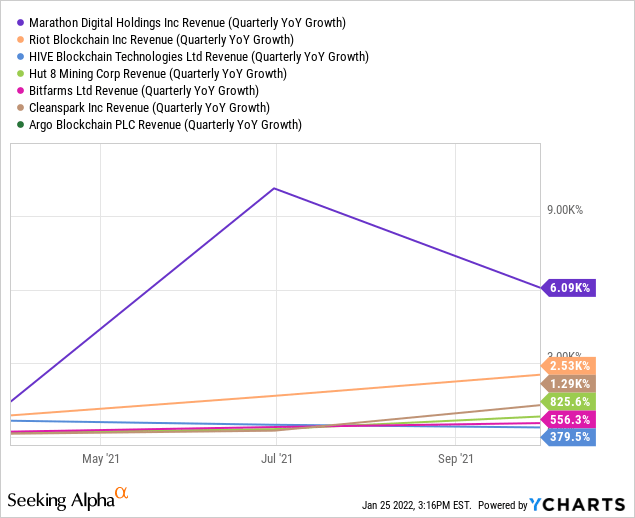

The first point is that growth for the group has been “spectacular” with most reporting Q3 2021 revenues multiple times higher compared to the period in 2020. This considers that most of these names began mining operations in earnest last year, ramping up production into the higher pricing environment.

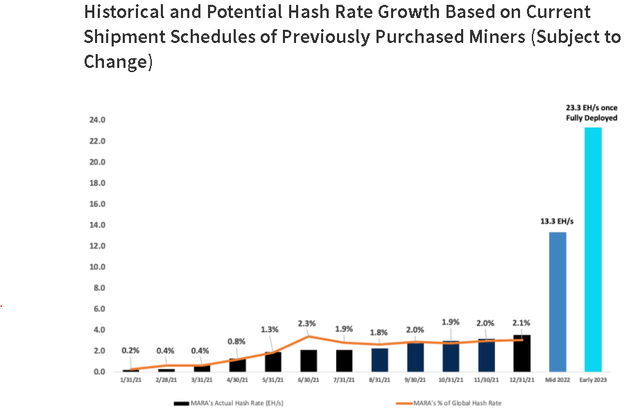

Marathon Digital stands out with Q3 revenue growth of 6,100% having generated $52 million in Bitcoin revenue compared to less than $1 million in the period last year. The company ended 2021 with 3.5 EH/s in hash rate which represented about 2.1% of the global Bitcoin network. The attraction in the stock is the outlook for the hash rate to grow nearly 5x by “mid-2022” to a 13.3 EH/s target and reach 23.3 EH/s by early 2023 considering its latest miners purchase.

So going back to the table, while MARA did not mine the most Bitcoin in 2021, and does not have the current largest hash rate capacity, the company has announced the largest capacity expansion justifying its group-leading market cap right around $2.2 billion. On that point, also consider each company’s balance sheet BTC holdings. MARA’s 8,133 has a current market value of around $300 million. This is in contrast to Core Scientific which mined 5,769 BTC in 2021with a current 6.6 EH/s hash rate capacity but has a smaller balance sheet BTC holding at 5,296.

For the miners with available consensus estimates, the growth trends are set to continue at impressive rates through 2022 benefiting from the production ramp-up and the base effect even as cryptocurrencies prices have trended lower. Note that some of these companies are already reporting positive earnings for 2021 as a measure of current profitability which will also climb into 2022. The figures look even better out towards 2023 considering many companies are set to significantly expand capacity this year meaning revenues will reach their full annualized potential towards Q4 2022.

Again, making direct comparisons on these companies based on a single metric is difficult for various reasons considering each miner has company-specific developments. What we can do is take the announced “potential hash rate” capacity and standardize that as a future annualized revenue run rate. We know that the network difficulty will continue to climb following the ~25% increase in 2021. Let’s assume that the global hash rate reaches 250 EH/s by the end of 2022, implying another 25% increase this year.

At that level, any miner that is generating 1 EH/s would control approximately 0.4% of the daily network Bitcoin reward which mints approximately 328,500 BTC over the entire year. In this case, assuming a flat hash rate, a 1 EH/s miner can expect to produce 1,314 BTC over a full year which translates into $48 million of revenue at the current BTC market price of $36,500.

From there we can standardize each Bitcoin miner’s valuation as a measure of their potential future annual revenue run rate against the current market cap. With the table below, some of the Bitcoin miners appear relatively more or less expensive than others based on their current market cap to announced hash rate deployments.

The caveat here is that this metric does not tell the whole story. Cipher Mining for example appears “cheap” with a 0.7x multiple against its current $651 million market cap. In this case, while Cipher expects to aggressively scale towards 19.5 EH/s through 2022, the company has not yet begun mining operations or reported any BTC on its balance sheet. Hut 8 Mining and HIVE Blockchain, each with a 5.5x and 3.8x multiple to our metric look “expensive” although the table below does not consider its more extensive Ethereum mining operation which requires a separate revenue forecast.

Furthermore, the market is also adding a premium to names depending on the scope of their diversified business across blockchain tech, hosting, or owned energy infrastructure. A deeper dive should also consider backing out each company’s BTC holdings to the equity value while also noting some of the companies are leveraged with debt on their balance while others are net cash. Another point is that some companies expect to expand production but have not disclosed specific targets in terms of hash rate potential which is the case with BIT Mining Limited (BTCM) which has instead focused on expanding its mining pool business.

Bitcoin Mining Stocks Outlook 2022

We’re looking at Bitcoin mining stocks as a high-beta play and leveraged to the price of Bitcoin. The group stands to benefit from a rebound in BTC which would help to also lift sector sentiment. If there is a bullish case that sees BTC climbing back above $60k this year or even a breakout higher, we would expect the miners to generate larger returns in percentage terms targeting each stock’s previous all-time high as an upside target. We’ve previously cited the $30k level as technical support the bulls must hold and we think a bottoming pattern now can represent the start of a new rally.

The silver linings to the selloff are that valuations for the miners have been reset lower, even underperforming the price of Bitcoin compared to levels from Q3 last year. Our interpretation is that some of these names are at a discount and have relative value simply considering the cash flow potential in a flat pricing environment from here over the next year.

2022 will be a critical year for the industry because the companies will begin to present normalizing financial results providing a clearer picture of metrics like operating margins, cash flows, and long-term earnings potential. We see room for some consolidation between miners to generate synergies. We recommend focusing on the mining “leaders” that are ramping up growth and proving they can navigate the current pricing environment.

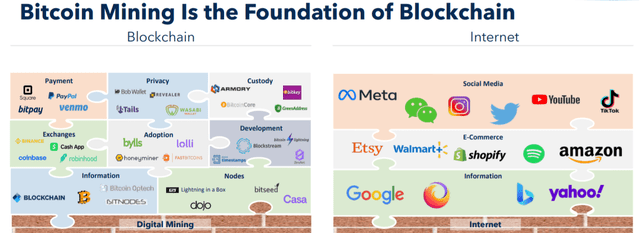

Despite the current market volatility, the long-term bullish case for Bitcoin and cryptocurrencies as a legitimate alternative asset class, store of value, and payments systems remains in place. There is a sense that BTC is supported by a growing digital ecosystem including adoption by a growing number of major corporations. Marathon Digital describes Bitcoin Mining as the “foundation of blockchain” akin to how the internet is central to the wide range of different tech platforms.

One of the attractions of Bitcoin is that its total supply is limited to 21 million BTC while more than 90% have already been mined. That scarcity into a growing diversification of the investor base which now includes institutions represents an underlying tailwind to push prices higher over time. Bitcoin miners building market share can end up accumulating large positions in digital assets over time leading to new growth opportunities including crypto lending and payments which is the direction we expect the industry to take.

Final Thoughts

Bitcoin miners are still the “wild west” of the stock market with the main risk being the connection to the price of Bitcoin. Another leg lower for BTC under $30k or a more concerning deterioration to the broader macro environment can open the door for more downside in the group. Any type of regulatory crackdown in the United States towards Bitcoin mining or cryptocurrencies, in general, is also a risk to watch. Still, seeing a future with Bitcoin and cryptocurrencies playing a larger role in the global economy, the mining stocks stand to benefit with significant upside. Tactically, we are bullish at the current level.

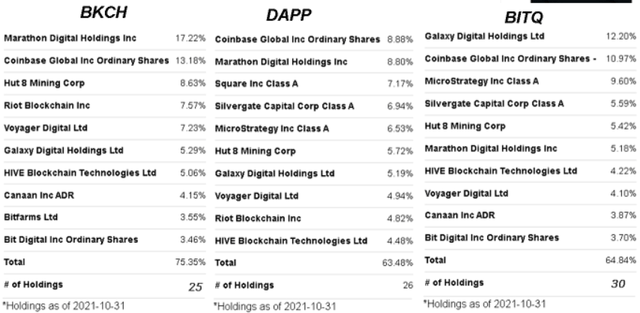

For those not yet ready to take the plunge in investing in bitcoin miners, one option is to consider a group of crypto stocks ETFs that take a broader approach to the sector including more diversified blockchain-related companies. The Global X Blockchain ETF (BKCH), Bitwise Crypto Industry Innovators ETF (BITQ), and The VanEck Digital Transformation ETF (DAPP) all provide targeted exposure to the sector including positions in several of the bitcoin mining stocks discussed above. Investors interested in any crypto security stock should only consider a small position in the context of a diversified portfolio.

Add some conviction to your trading! Exclusive stock ideas from our “ALPHA PICKS” along with the best daily market trading commentary. Join the community and active chat room. Click here for a two-week free trial at the Conviction Dossier.

This article was written byBOOX Research14.84K FollowersAuthor of Conviction DossierOutside-the-box trade ideas through a powerful multi-sector strategy.

The most extensive coverage on SA! We combine fundamental analysis with a data-driven approach to find “outside the box” ideas.

15 years of professional experience in capital markets and investment management at major financial institutions.

Check out our private marketplace newsletter service *Conviction Dossier* for curated trade ideas.Show moreFollow

Disclosure: I/we have a beneficial long position in the shares of MARA, BTC-USD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.29 CommentsCommentNever miss the best stock ideas!Stock Ideas Newsletter264,497 subs.

Recommended For You

The Crypto Rally: Marathon Digital Is The Best Bitcoin Mining Stock To Buy

BOOX Research

Riot Blockchain: Not Best In Class

Brett Rodway

Block: Market Has Lost Its Mind, It’s Time To Buy

The Digital Trend

Realty Income Finally Dips

Colorado Wealth Management Fund

Successfully Trading HIVE Blockchain And Other Bitcoin Proxy Stocks

Gary Bourgeault

Comments (29)

Sort by

BOOX Research11 Feb. 2022, 10:03 AMMarketplace ContributorPremiumComments (3.22K)|We did an update for February here.

seekingalpha.com/…mmutsavj02 Feb. 2022, 10:58 AMComments (1.02K)|This is truly all that had to be said for the neophytes to crypto …”and reach 23.3 EH/s by early 2023″ (that’s MARA’s goal hash rate!). This will dwarf all others and certainly make MARA best in breed (domestically). It’s almost like GOOGL with all it’s “firepower” …unstoppable. That’s MARA in a few more quarters. Wait & watch …and yeah, sell covered calls on your stock positions as you wait for the Rewards!

Doba202 Feb. 2022, 11:43 AMComments (265)|@mutsavj A companies goal is just that, a goal.